Case Study

London Law firmOne of the world’s largest law firms

Testimonial

“Simply put, with PARIS Tech’s Solution we have access to much more information, more frequently, than we did before. That puts us in a much better position to support the growth and profitability of the London Law Firm organization. What’s also significant is that the efficiency

and productivity improvements we gained from the PARIS Tech’s Solution allowed us to achieve a full return on our investment in the first year.”

CFO, London Law Firm

Intro

Streamline two vital components of the firm’s financial processes:

- Budgeting

- Reporting

Enable management to view and analyze its financial performance more quickly, more frequently, and in much greater detail.

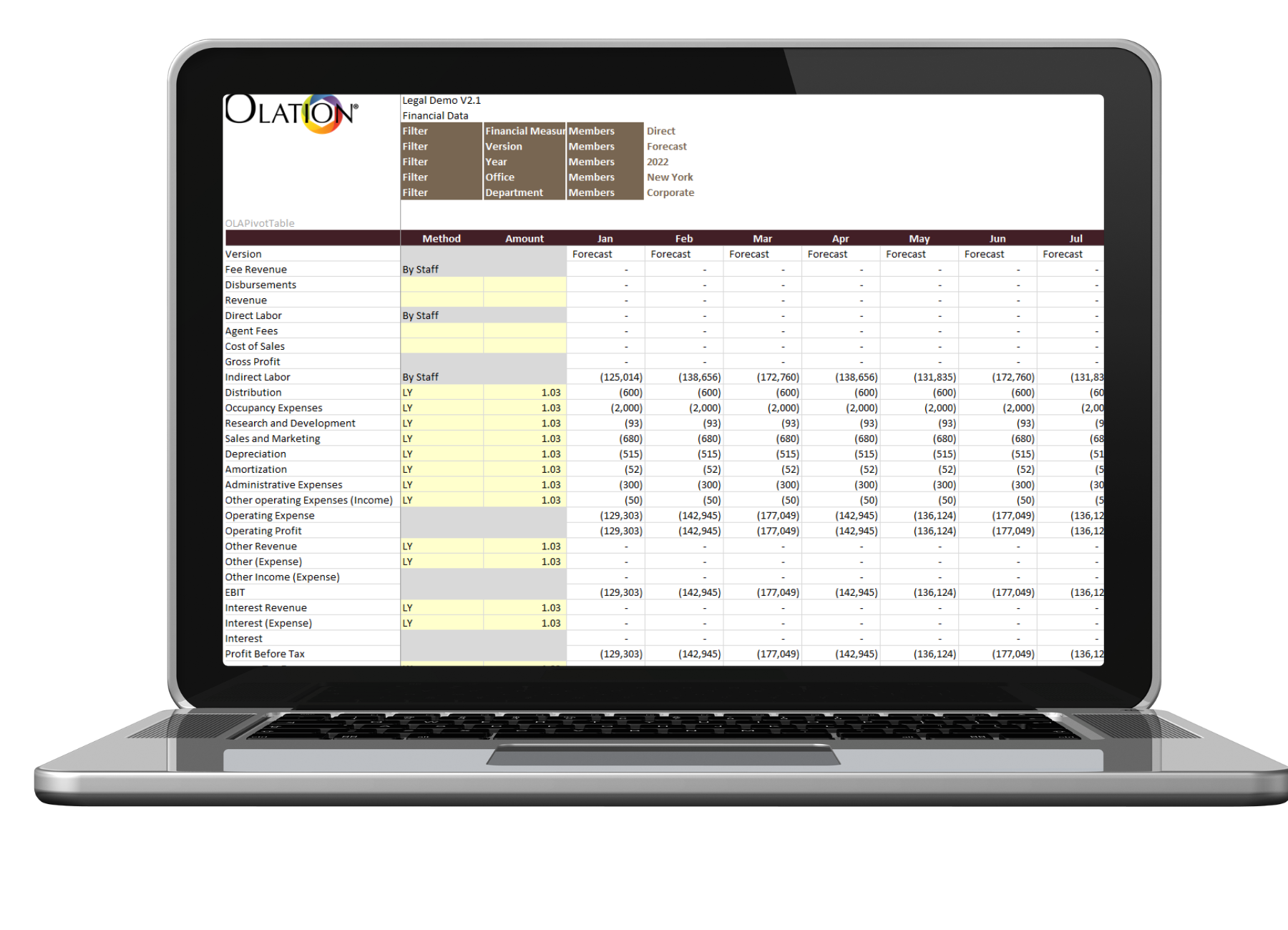

SOLUTION: PARIS Tech Management Solution for Budgeting, Reporting & Analysis.

Details

The Challenges

overview

This London Law Firm is one of the largest law firms in the world. With 17 offices in Europe, and three affiliated offices in Asia, the firm’s 4,000 employees serve hundreds of large businesses around the globe. The firm’s principal areas of work include corporate, commercial, employment and pensions, litigation and disputes, property and commoditized services–specialties that are the focus of the firm’s six practice groups. These groups are organized further into 32 different groups that specialize in other areas, such as intellectual property or intellectual technology law. Over the past few years, London Law Firm implemented an. Elite practice management system to serve as a common platform for the collection of transaction data such as employee time records, as well as invoice and payment records. With that in place, the firm turned its attention to other new management. information tools. Specifically, it wanted to find a way to streamline the budgeting and reporting processes through the more efficient collection, consolidation, and analysis of the vast amount of vital data dispersed throughout the organization.

business challenge

London Law Firm faced the challenge of streamlining its budget & financial reporting processes. The goal was to replace a cumbersome spreadsheet-based system with a process that would be able to retrieve higher quality data, on a more frequent basis, and with greater penetration into the depth of the organization–one that would drill down to deeper levels of detail. The firm was also seeking a solution that would allow it to view the organization in a consistent way across its various dimensions–geographically and by practice and product groups. Additionally, London Law Firm sought a solution for managing its customer relationships, one that would enable it to provide the kind of high-level information and feedback their clients would value.

Employees

4k+

European offices

17

Asian offices

3

Customers

100+

Details

Background

Historically, London Law Firm budget & reporting processes were supported by a spreadsheet-based system that collected and collated data on a quarterly basis through seven regional offices in the UK. In developing the budget, each of the seven centers summarised data into a variety of spreadsheet reports that were forwarded to a small central finance team, who consolidated the data into a firm-wide data set. However, because structurally, London Law Firm operates in two dimensions–geographically and by practice discipline–it wanted budget information and reports to be equally available from both dimensions at the same time. “That was something that our previous implementation of spreadsheets was just not coping with adequately,” according to the Finance Director of London Law Firm. The process was also much too labor-intensive, took much time, and data was lacking in depth. As he explains it, “In all, as many as 15 people were putting a significant amount of time into this every quarter, yet developing the budget took several weeks to complete. The reporting process took three weeks to collect the data and another three weeks to consolidate and verify its accuracy. We needed information faster and more frequently, and reporting was required on a monthly basis rather than quarterly. What’s more, there were inconsistencies in the application of the data. And the budget and reporting model itself was too shallow to provide the detail necessary for team modeling.” The Finance Director knew that as management pressed for more frequent, accurate, and detailed information, the firm’s cumbersome process would no longer be adequate to meet the increasing demands. The Finance Director and his colleagues took action. They established a project team to research and evaluate the best available financial modeling and consolidation products.

Details

The Solution

Solution

The new team quickly short-listed three companies that requested full proposals and narrowed the field to two products, one of them PARIS Tech’s Business Intelligence Solution. PARIS Tech’s Solution was clearly in sync with the London Law Firm’s values. “We use three words to describe our firm and the way we work”, he explains.

“Straightforward, enterprising, and effective. After evaluating the three proposals and products, we felt PARIS Tech offered the most straightforward, direct, and effective approach.”

The key factors in London Law Firm’s selection of PARIS’

solution included:

- Ease-of-use: unlike other more expensive and complex products, London Law Firm felt it could implement and learn how to use PARIS Tech quickly.

- Flexibility: the firm was impressed with PARIS Tech’s facility for moving data around and creating data cubes that reflected the multiple dimensions

of its business. - Responsiveness: PARIS Tech was extremely responsive to questions and requests.

- Reliability: PARIS Tech is proven effective in the legal market, with nearly 20% of the top 100 US firms using it for budgeting & forecasting, reporting, and profitability analysis

Results

A Better Budget:

The rewards to London Law Firm were almost immediate. Just a few months after implementation, London Law Firm used the PARIS Tech Solution to create its next-year budget. This was accomplished by establishing a common model that formed a basic foundation for :

1. Capturing the necessary depth of detail and

2. Looking at data and information from multiple dimensions.

“We were also able to provide managers with much more information than before,” says Finance Director, “which led to better decisions about how London Law Firm wanted to shape the business for the ensuing year.”

More Frequent, Quality Reports:

With the budget complete, the finance team turned its attention to the frequency, quality and depth of its reports. The objective was to generate detailed, quality, real-time reports on a monthly basis instead of quarterly. Today, says Finance Director, “we’re getting faster and faster in terms of our reporting time scales. As of September, we had not only eliminated four weeks from our previous six week reporting cycle, we were reviewing a lot more detailed data in that reduced timeframe-data which previously was not available within the organization, except at a very low level and in inconsistent forms. Looking ahead, we expect to shave a few more working days from the basic process of quality control and collection. We will also save additional time as we move into automatic data collection from our underlying transaction database.”

New Capabilities:

The Finance Director cites several other benefits including a capability for benchmarking between comparable practice groups. Because the PARIS Tech Solution offers multiple lateral views across levels, teams, and individuals, it provides a more legitimate basis for the comparison of peer-group performance. “We’re not a very centralized organization, so we’re very keen that data be available to all parts of the organization. This is a capability that has also helped our offices work together and match the right people with the right clients.” As London Law Firm continued to work with the PARIS Tech solution, other applications proved advantageous. One of these is the more efficient delivery of customer relationship information, which is derived from the reporting process. Each customer has their own requirements for how they want to receive information on their legal spend and the status of their various legal matters. “We plan to use the PARIS Solution to solve this application.”

Contributing to Growth and Profitability:

“Simply put”, says the Finance Director, “with the PARIS Tech Solution, we have access to much more information, more frequently, than we did before, which puts us in a much better position to support the growth and profitability of the London Law Firm organization.” For example, London Law Firm can now react more quickly to divert resources to a particular market. “We’re able to put a large team in place on short notice to support our public inquiry or government work.

This reflects our more efficient management of large-scale projects, which is essential for keeping our business profitable. In that vein, it’s significant that the efficiency and productivity improvements we gained from the PARIS Tech solution allowed us to achieve a full return on our investment in the first year.”

PARIS Tech delivers:

For London Law Firm, PARIS Tech’s penetration into the US legal market was a distinguishing factor and gave them a familiarity with their business. Says the Finance Director, “The PARIS Tech Group has high-caliber people with the content expertise necessary to understand the business of law firms and the ability to apply technology to their business processes. They have been highly responsive to our needs. When you need help, they deliver in an effective and efficient manner,” says the Finance Director, who concludes: “I‘d tell my peers at other law firms that if they are not aware of PARIS Tech’s Solution, they should have a good look at it because we‘ve found it very useful at London Law Firm. I would be very surprised if they didn’t derive a significant benefit, as well as return on investment that is similar to ours.”